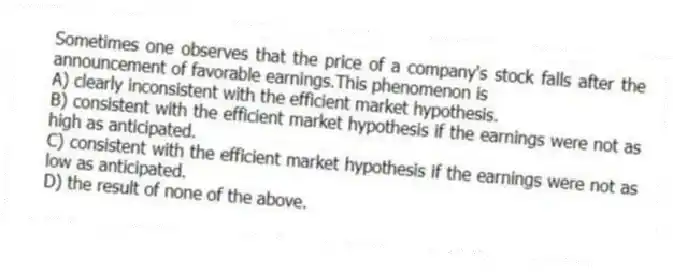

Sometimes one observes that the price of a company's stock falls after the announcement of favorable earnings.This phenomenon is

A) clearly inconsistent with the efficient market hypothesis.

B) consistent with the efficient market hypothesis if the earnings were not as high as anticipated.

C) consistent with the efficient market hypothesis if the earnings were not as low as anticipated.

D) the result of none of the above.

Correct Answer:

Verified

Q26: According to the January effect,stock prices

A) experience

Q27: The elimination of a riskless profit opportunity

Q28: An investor gains from short selling by

Q29: Which of the following does not weaken

Q30: An important lesson from the Black Monday

Q32: Which of the following is empirical evidence

Q33: The efficient market hypothesis suggests that

A) investors

Q34: The efficient market hypothesis applies to

A) both

Q35: According to the strong view of the

Q36: Which of the following is an insight

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents