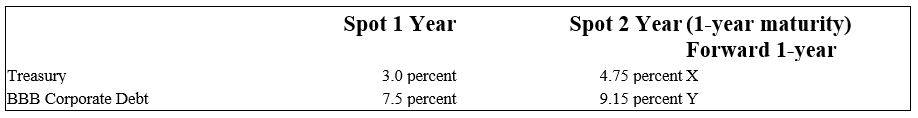

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The duration of a soon to be approved loan of $10 million is four years.The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. What is the estimated risk-adjusted return on capital (RAROC) of this loan.

A) 6.36 percent.

B) 7.00 percent.

C) 7.13 percent.

D) 10.55 percent.

Correct Answer:

Verified

Q106: The following is information on current spot

Q107: The following is information on current spot

Q108: The following is information on current spot

Q109: The following represents two yield curves.

Q110: The following represents two yield curves.

Q112: The following represents two yield curves.

Q113: The following is information on current spot

Q114: The following represents two yield curves.

Q115: The following represents two yield curves.

Q116: The following is information on current spot

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents