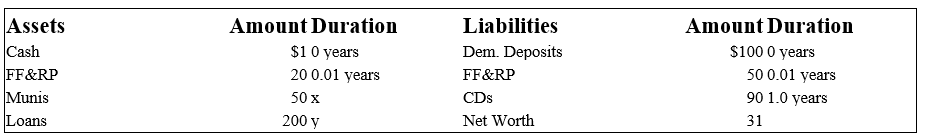

The following is an FI's balance sheet ($millions) .

Notes to Balance Sheet.

Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. CDs are 1-year pure discount certificates of deposit paying 4.75 percent.

-What is this bank's interest rate risk exposure,if any?

A) The bank is exposed to decreasing interest rates because it has a negative duration gap of -0.21 years.

B) The bank is exposed to increasing interest rates because it has a negative duration gap of -0.21 years.

C) The bank is exposed to increasing interest rates because it has a positive duration gap of +0.21 years.

D) The bank is exposed to decreasing interest rates because it has a positive duration gap of +0.21 years.

Correct Answer:

Verified

Q104: A bond is scheduled to mature in

Q114: Q115: The numbers provided are in millions of Q116: U.S. Treasury quotes from the WSJ on Q117: The numbers provided by Fourth Bank of Q118: The numbers provided are in millions of![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents