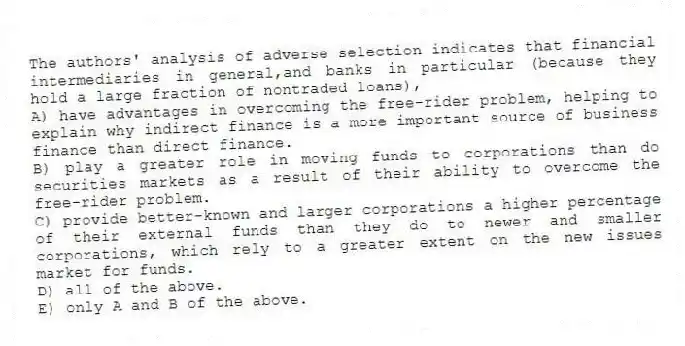

The authors' analysis of adverse selection indicates that financial intermediaries in general,and banks in particular (because they hold a large fraction of nontraded loans) ,

A) have advantages in overcoming the free-rider problem, helping to explain why indirect finance is a more important source of business finance than direct finance.

B) play a greater role in moving funds to corporations than do securities markets as a result of their ability to overcome the free-rider problem.

C) provide better-known and larger corporations a higher percentage of their external funds than they do to newer and smaller corporations, which rely to a greater extent on the new issues market for funds.

D) all of the above.

E) only A and B of the above.

Correct Answer:

Verified

Q19: Commercial and farm mortgages,in which property is

Q31: That most used cars are sold by

Q32: The authors' analysis of adverse selection indicates

Q33: Because of the adverse selection problem,

A) good

Q34: An audit certifies that

A) a firm's loans

Q35: Property that is pledged to the lender

Q37: The pecking order hypothesis predicts that the

Q38: Financial intermediaries (banks in particular)have the ability

Q39: Collateral is

A) property that is pledged to

Q41: A debt contract is said to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents