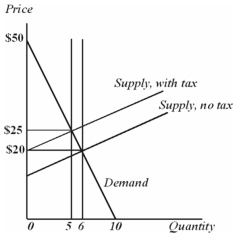

This graph illustrates the market for groceries with and without a per unit tax:

The deadweight loss of this tax is

A) relatively large because it is a tax on a necessity.

B) relatively small because it is a tax on a necessity.

C) zero because the tax money is used to benefit citizens of the state.

D) the distance between the two supply curves.

Correct Answer:

Verified

Q134: This graph illustrates the market for groceries

Q135: A bill is before your state legislature

Q136: If all relevant private and social costs

Q137: If low-income households spend a larger share

Q138: The deadweight loss from imposing a tax

Q140: According to the textbook,in repeated experiments when

Q141: The taxing agency in your state would

Q142: Suppose that you have estimated that demand

Q143: Suppose that you have estimated that demand

Q144: Suppose that you have estimated that demand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents