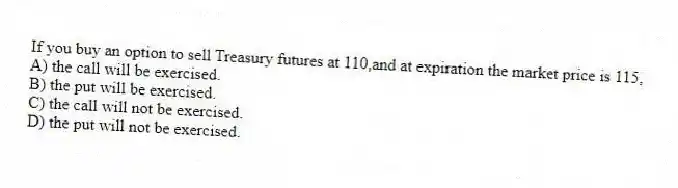

If you buy an option to sell Treasury futures at 110,and at expiration the market price is 115,

A) the call will be exercised.

B) the put will be exercised.

C) the call will not be exercised.

D) the put will not be exercised.

Correct Answer:

Verified

Q54: The agency which regulates futures options is

Q55: An option that can be exercised only

Q56: A put option gives the owner the

Q57: A call option gives the owner the

Q58: A put option gives the seller the

Q60: An option that gives the owner the

Q61: All other things held constant,premiums on both

Q62: One advantage of using swaps to eliminate

Q63: As compared to a default on the

Q64: The disadvantage of swaps is that

A) they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents