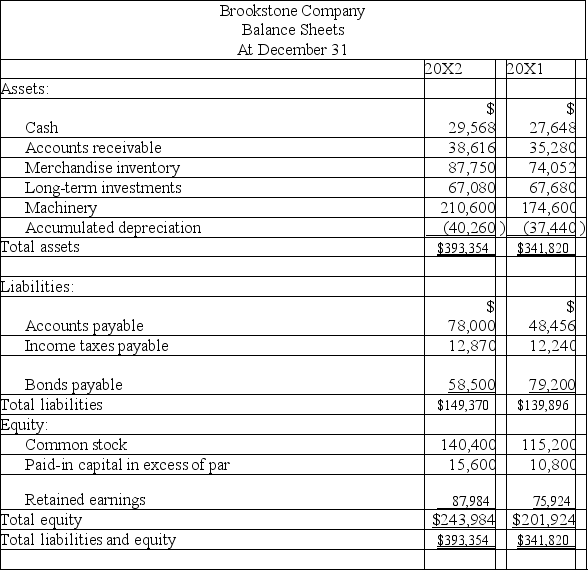

The Following Information Is Available for the Brookstone Company Additional Information:

(1) There Was No Gain or Loss on \text

The following information is available for the Brookstone Company:

Additional information:

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old machinery with an original cost of $45,060 was sold for $2,520 cash.

(3) New machinery was purchased for $81,060 cash.

(4) Cash dividends of $40,320 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Use the following company information to calculate

Q185: Rowan, Inc.'s, income statement is shown

Q187: The following information is available for

Q189: Explain how cash flows from investing and

Q192: Explain how the cash flows from operating

Q192: Use the following income statement and

Q193: Explain the use of a spreadsheet in

Q194: Based on the following income statement

Q196: Use the following company information to prepare

Q200: Define the cash flow on total assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents