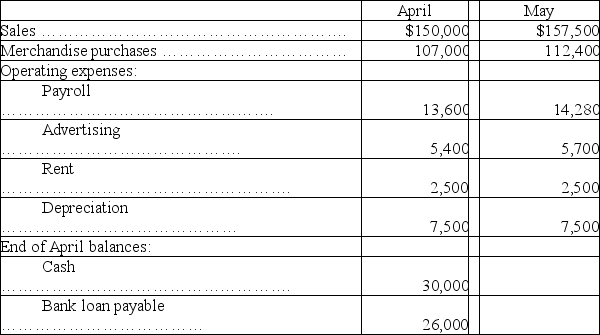

Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $25,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Correct Answer:

Verified

Q142: Stanley Company is preparing a cash budget

Q183: Groundworks Company budgeted the following credit sales

Q185: A sporting goods store budgeted August purchases

Q189: The following information is available for Jergenson

Q189: Use the following data to determine the

Q190: Argenta, Inc. is preparing its master budget

Q192: Widmer Corp. requires a minimum $10,000 cash

Q195: Addams, Inc., is preparing its master budget

Q196: Dado, Inc. is preparing its budget for

Q197: Oxford, Inc., is preparing its master budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents