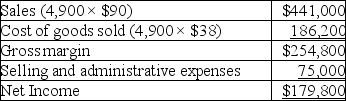

Aces, Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,000 rackets and sold 4,900. At year-end, the company reported the following income statement using absorption costing.  Production costs per tennis racket total $38, which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) . Ten percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per tennis racket total $38, which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) . Ten percent of total selling and administrative expenses are variable. Compute net income under variable costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

Correct Answer:

Verified

Q122: What is Red and White's net income

Q125: Pact Company had net income of $972,000

Q134: Given the following data, calculate the total

Q135: Wind Fall, a manufacturer of leaf blowers,

Q136: Identify the treatment of each of the

Q139: Tim's Tools, a manufacturer of cordless drills,

Q140: Swisher, Incorporated reports the following annual cost

Q141: A company is currently operating at 70%

Q153: What is the general procedure for converting

Q154: Assume a company sells a given product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents