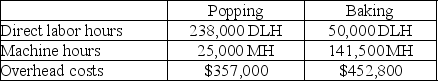

Blast Rocket Company manufactures candy-coated popcorn treats that go through two operations, popping and baking, before they are complete. Expected costs and activities for the two departments are shown in the following table

:

a. Compute a departmental overhead rate for the popping department based on direct labor hours.

a. Compute a departmental overhead rate for the popping department based on direct labor hours.

b. Compute a departmental overhead rate for the baking department based on machine hours.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q184: Slosh, Inc. produces washing machines that require

Q185: A company's total expected overhead costs and

Q186: Freeze Frame, Inc. produces cameras that require

Q187: Rising Sun, Inc. produces granola that requires

Q188: Time Bender Company makes watches and clocks.

Q190: Lemon Yellow Company produces children's clothing that

Q191: A company uses activity-based costing to determine

Q192: Outer Limits, Inc. produces fencing units which

Q193: A company uses activity-based costing to determine

Q194: Fischer Company identified the following activities, costs,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents