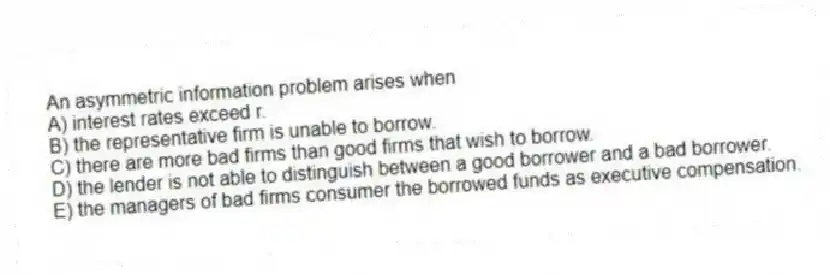

An asymmetric information problem arises when

A) interest rates exceed r.

B) the representative firm is unable to borrow.

C) there are more bad firms than good firms that wish to borrow.

D) the lender is not able to distinguish between a good borrower and a bad borrower.

E) the managers of bad firms consumer the borrowed funds as executive compensation.

Correct Answer:

Verified

Q30: The output supply curve is the relationship

Q31: When drawn against the real interest rate,the

Q32: An increase in the default premium

A) raises

Q33: The marginal benefit from investment for a

Q34: Investment tends to be more variable over

Q36: When drawn against the real interest rate,the

Q37: A firm that is a lender finances

Q38: The marginal cost of investment for the

Q39: Investment will be more variable if

A) there

Q40: An increase in G or G' shifts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents