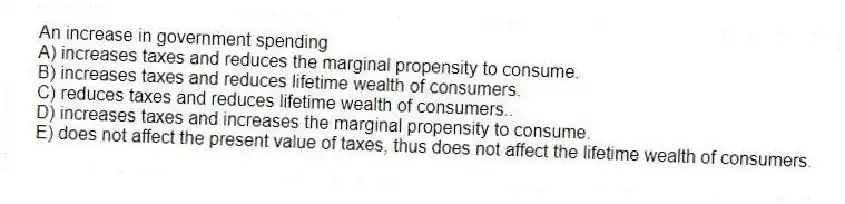

An increase in government spending

A) increases taxes and reduces the marginal propensity to consume.

B) increases taxes and reduces lifetime wealth of consumers.

C) reduces taxes and reduces lifetime wealth of consumers..

D) increases taxes and increases the marginal propensity to consume.

E) does not affect the present value of taxes, thus does not affect the lifetime wealth of consumers.

Correct Answer:

Verified

Q38: The marginal cost of investment for the

Q39: Investment will be more variable if

A) there

Q40: An increase in G or G' shifts

Q41: The decrease in lifetime wealth affects consumption

Q42: An increase in total factor productivity causes

A)

Q44: In response to a temporary increase in

Q45: The output demand curve shows the

A) positive

Q46: Multipliers above 1 occur in models that

Q47: When drawn against the real interest rate,the

Q48: The total government expenditure multiplier is less

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents