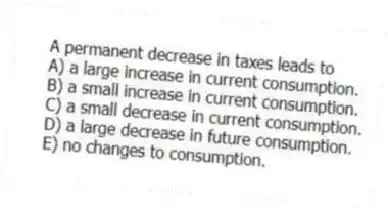

A permanent decrease in taxes leads to

A) a large increase in current consumption.

B) a small increase in current consumption.

C) a small decrease in current consumption.

D) a large decrease in future consumption.

E) no changes to consumption.

Correct Answer:

Verified

Q24: The property of diminishing marginal rate of

Q25: A consumer is a lender if

A) optimum

Q26: If consumers expect a tax cut to

Q27: A change in the stock market is

Q28: The two primary explanations for the excess

Q30: A good proxy for the flow of

Q31: According to Friedman,a primary determinant of a

Q32: Aggregate consumption is

A) positively related to savings.

B)

Q33: An increase in first-period income results in

A)

Q34: A martingale has the property that

A) it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents