Use the following to answer question(s) : Tax Incidence

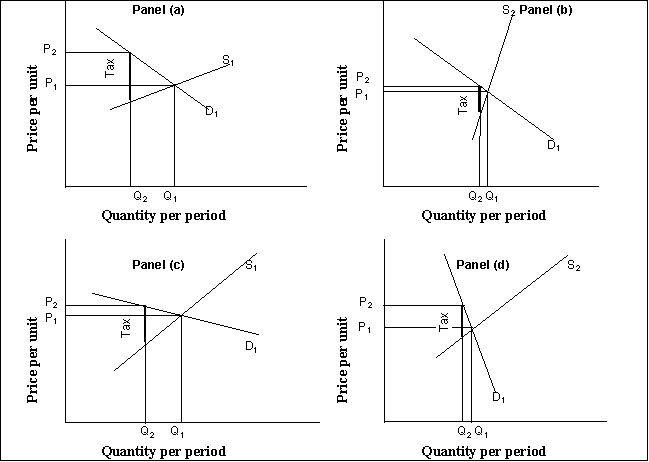

-(Exhibit: Tax Incidence) All other things unchanged, when a good or service is characterized by a relatively inelastic supply, as shown in Panel _______ , the greater share of the burden of an excise tax imposed on it (shown by the tax wedge in each panel) is borne by _______ .

A) (a) ; buyers

B) (b) ; sellers

C) (a) ; sellers

D) (b) ; buyers

Correct Answer:

Verified

Q105: An example of a tax based on

Q106: The burden of a tax that is

Q107: Taxes paid on the wages received from

Q108: Deciding whether the ultimate burden of a

Q109: A progressive tax is one that takes:

A)

Q111: It is the _ that matter(s) in

Q112: Determining whether the burden of taxes falls

Q114: Use the following to answer question(s): Tax

Q115: Tax incidence analysis seeks to determine:

A) who

Q163: In analyzing the impact of a progressive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents