Redmond Manufacturing Company began operations on January 1.The Company was affected by the following events during its first year of operation:

a)Company issued stock to owners for $100,000 cash.

b)Purchased materials,$8,000 for cash.

c)Transferred $4,000 of direct materials to production (Job #1: $3,000;Job #2: $1,000).

d)Paid direct labor costs,$5,000 (Job #1: $2,500;Job #2: $2,500).

e)Paid $3,000 cash for various actual overhead costs.

f)Allocated overhead to work in process at 60% of direct labor cost.

g)Completed Job #1 and transferred it to Finished Goods.

h)Sold Job #1 for $8,400 cash.

i)Paid $200 cash for selling and administrative expenses.

Required:

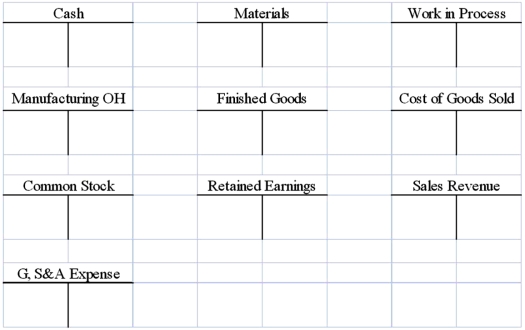

1)Record the above events in the T-accounts provided.Label your transactions (a)- (i).

2)Determine the ending balance in the work in process account.

3)Prepare a schedule of cost of goods manufactured and sold.

4)Compute the amount of gross profit earned on Job #1.

Correct Answer:

Verified

1)Posted T-accounts:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Describe the conflict between the need for

Q107: What is a volume variance,and what is

Q123: Winken,Blinken,and Nod is a law firm specializing

Q124: In calculating product costs,actual direct materials and

Q126: Lake Manufacturing estimated its product costs

Q127: The Hamilton Company planned to produce 150,000

Q128: The cost structure for Chiang Company, which

Q128: Which is required for preparation of a

Q130: Selected T-accounts from the books of Street

Q133: Selected accounts from Harper Company are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents