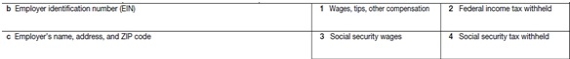

Annabelle is employed as an administrator for GRM Industries.She noticed that her Box 1 and Box 3 amounts on her W-2 were different.  What is a reason why the amounts in boxes 1 and 3 would be different?

What is a reason why the amounts in boxes 1 and 3 would be different?

A) Annabelle received tips, which are not subject to Social Security taxes.

B) Annabelle has contributed to a pre-tax 401(k) that reduced her taxable wages.

C) Annabelle changed her withholding allowances on her W-4.

D) Annabelle's wages were subject to a pre-tax garnishment.

Correct Answer:

Verified

Q25: Van Oot's Bicycles had $19,489 of payroll

Q27: McBean Farms has the following information on

Q28: Red's Waterworks is a semiweekly depositor.One month

Q28: Collin's Pool Service files a Form 944

Q30: Cralic Company has 12 employees and operates

Q31: Lesch & Sons has been and is

Q32: Kohlmeier Industries had $87,950 of annual payroll

Q33: McBean Farms has the following information on

Q37: Daigneault Designs has the following amounts listed

Q59: Which copy of Form W-2 should be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents