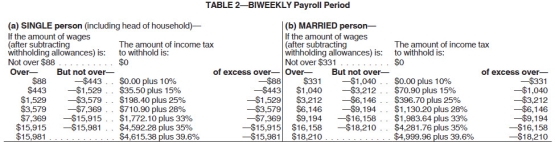

Amanda is a full-time exempt employee who earns $84,000 annually.She is married with 1 deduction and is paid biweekly.She contributes $150.00 per pay period to her 401(k) and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00,respectively.Amanda contributes $25.00 per pay period to the United Way.What is her net pay? (Use the percentage method.Do not round intermediate calculations. Round final answers to 2 decimal places.)

A) $2,394.47

B) $2,193.60

C) $2,352.25

D) $2,605.44

Correct Answer:

Verified

Q42: Tierney is a full-time nonexempt salaried employee

Q44: What is not a reason why an

Q45: Danny is a full-time exempt employee

Q46: From the employer's perspective,which of the following

Q48: Manju is a full-time exempt employee living

Q48: What is an advantage of direct deposit

Q49: What is a disadvantage to using paycards

Q52: Brent is a full-time exempt employee in

Q53: Which of the following is true about

Q59: Which body issued Regulation E to protect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents