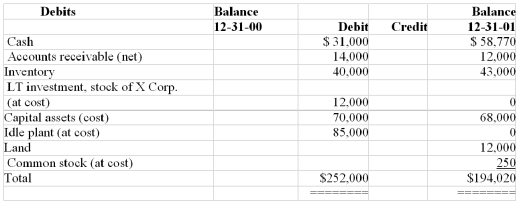

ABC Company has just completed the December 31,2001,financial statements except for the Statement of Cash Flows.Information on changes in accounts appears in tabular format below.Additional information for 2001:

a.Net income,$16,000.

b.Depreciation expense,$5,000.

c.Cash dividend declared and paid,$4,000.

d.Declared and issued a $10,000 stock dividend,recorded at par.

e.December 30,2001,purchased a machine (a capital asset) for $10,000; paid half cash and issued a one year,18%,interest-bearing note of $5,000 for the balance.

f.Sold 20 shares of unissued shares at $26 per share,collected cash in full.

g.Repurchased 10 shares of their ABC shares at $25 per share (assume the single-transaction method is used for common stock),paid cash in full.

h.Purchased a tract of land and paid for it in full by exchanging for it all of the investment in X Corporation shares.The shares were quoted on the market at $12,000 (any gain or loss is included in income as an "ordinary" item).

i.Sold an idle plant for $6,000 cash.

j.Extraordinary gain of $2,000 (net of income tax) due to an earthquake (infrequent and unusual),which caused the loss of capital assets that originally cost $12,000 when they were two-thirds,depreciated; received $6,000 cash settlement from the insurance company.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: ABC had the following balances on its

Q148: Complete the following Statement of Cash Flows

Q156: The adjusted trial balances for a

Q157: A corporation is preparing a Statement of

Q159: A firm reported the following in

Q162: VJW received the following cash inflows during

Q162: Two formats of presenting the Statement of

Q165: If cash collected from customers for 2011

Q172: RJB reported sales of $200,000 and an

Q174: A firm's accumulated depreciation account increased $30,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents