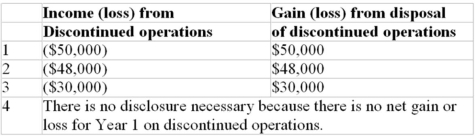

Jacks Corporation decided to sell its playing card business segment for $600,000,on September 1,Year 1.The disposal date is November 1,Year 1.The book value of the segment's net assets is $550,000.The pre-tax income for the segment for the period January 1 - September 1,Year 1,was a loss of $80,000; the pre-tax income for the segment for September and October was $30,000.Assuming a tax rate of 40%,choose the correct reporting for discontinued operations in the income statement of Jacks Corporation,for the year ended December 31,Year 1.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q66: Sierra Inc.committed to sell its mountaineering

Q66: Under IFRS, a discontinued operation must be

Q67: Given the following amounts from an income

Q68: Basic and fully-diluted earnings per share under

Q69: King Corporation decided to sell its

Q71: Under ASPE,foreign exchange translation gains or losses

Q74: Future costs associated with a restructuring can

Q75: The results from operation of a discontinued

Q76: Constructive obligations:

A) Arise from a reasonable expectation

Q80: IFRS 5 defines a discontinued operation as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents