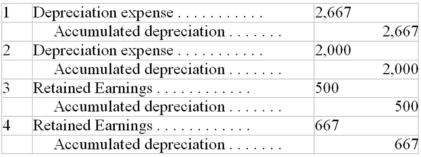

A company owns an operational asset acquired on January 1,2006 at a cost of $10,000.It had an estimated useful life of 5 years,no residual value,and was being depreciated on a straight-line basis.On December 31,2007,it was determined that the total useful life would be 4 years.The following adjusting entry (assuming no adjusting entries have been made) for the accounting year ended December 31,2007 should be made (rounded to the nearest dollar) :

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q37: The single-step income statement emphasizes

A)the gross profit

Q81: On May 1, 2005, a company purchased

Q86: On December 31, 2007, a company discovered

Q88: Under,IFRS,a loss should be presented separately

Q89: Which of the following is true about

Q90: A company had 30,000 shares of common

Q92: A transaction that is material in amount,

Q93: A company had 30,000 shares of common

Q93: Little uniformity is found on statements of

Q110: Gross billings for merchandise sold by Stratford

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents