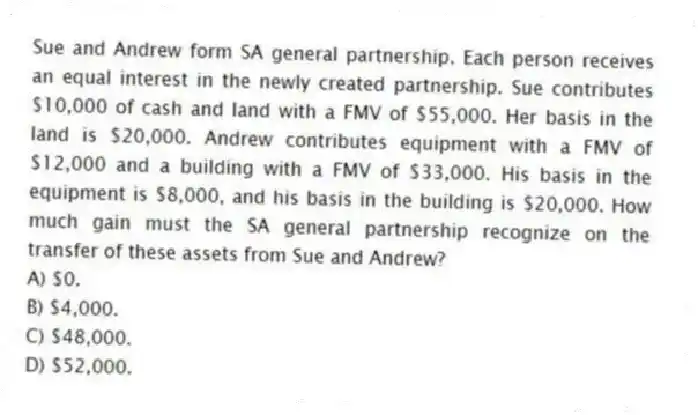

Sue and Andrew form SA general partnership. Each person receives an equal interest in the newly created partnership. Sue contributes $10,000 of cash and land with a FMV of $55,000. Her basis in the land is $20,000. Andrew contributes equipment with a FMV of $12,000 and a building with a FMV of $33,000. His basis in the equipment is $8,000, and his basis in the building is $20,000. How much gain must the SA general partnership recognize on the transfer of these assets from Sue and Andrew?

A) $0.

B) $4,000.

C) $48,000.

D) $52,000.

Correct Answer:

Verified

Q22: Partnerships may maintain their capital accounts according

Q25: A partner's tax basis or at-risk amount

Q26: Tom is talking to his friend Bob,

Q33: The main difference between a partner's tax

Q36: Zinc, LP was formed on August 1,

Q36: Which of the following does not represent

Q38: If a partner participates in partnership activities

Q39: In what order should the tests to

Q41: Kim received a 1/3 profits and capital

Q42: Which of the following does not adjust

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents