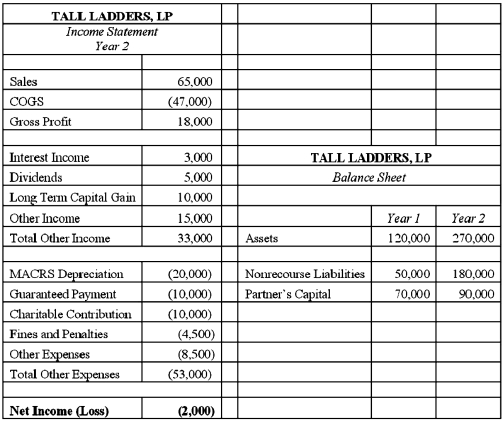

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: John, a limited partner of Candy Apple,

Q73: What is the difference between the aggregate

Q73: How does additional debt or relief of

Q75: If partnership debt is reduced and a

Q79: If a taxpayer sells a passive activity

Q82: Illuminating Light Partnership had the following

Q83: Jordan, Inc., Bird, Inc., Ewing, Inc.,

Q84: On June 12, 20X9, Kevin, Chris, and

Q95: On March 15, 20X9, Troy, Peter, and

Q111: What general accounting methods may be used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents