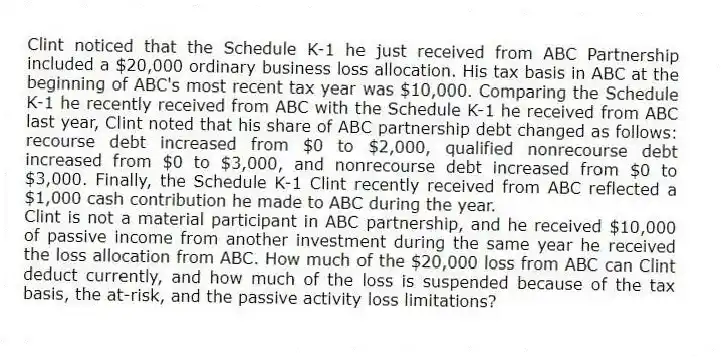

Clint noticed that the Schedule K-1 he just received from ABC Partnership included a $20,000 ordinary business loss allocation. His tax basis in ABC at the beginning of ABC's most recent tax year was $10,000. Comparing the Schedule K-1 he recently received from ABC with the Schedule K-1 he received from ABC last year, Clint noted that his share of ABC partnership debt changed as follows: recourse debt increased from $0 to $2,000, qualified nonrecourse debt increased from $0 to $3,000, and nonrecourse debt increased from $0 to $3,000. Finally, the Schedule K-1 Clint recently received from ABC reflected a $1,000 cash contribution he made to ABC during the year.

Clint is not a material participant in ABC partnership, and he received $10,000 of passive income from another investment during the same year he received the loss allocation from ABC. How much of the $20,000 loss from ABC can Clint deduct currently, and how much of the loss is suspended because of the tax basis, the at-risk, and the passive activity loss limitations?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: In each of the independent scenarios below,

Q97: On March 15, 20X9, Troy, Peter, and

Q99: Greg, a 40% partner in GSS Partnership,

Q101: Fred has a 45% profits interest and

Q104: Peter, Matt, Priscilla, and Mary began the

Q106: On January 1, 20X9, Mr. Blue and

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Q122: Bob is a general partner in Fresh

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents