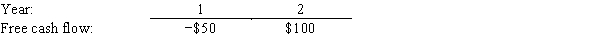

The free cash flows (in millions) shown below are forecast by Parker & Sons.If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2,what is the Year 0 value of operations,in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments) .

A) $1,456

B) $1,529

C) $1,606

D) $1,686

E) $1,770

Correct Answer:

Verified

Q10: The projected cash flow for the next

Q27: Reynolds Construction's value of operations is $750

Q29: The value of Broadway-Brooks Inc.'s operations is

Q39: Decker Tires' free cash flow was just

Q62: Kellner Motor Co.'s stock has a required

Q63: Hirshfeld Corporation's stock has a required rate

Q69: The Jameson Company just paid a dividend

Q77: Burke Tires just paid a dividend of

Q81: Alcott's preferred stock pays a dividend of

Q88: The required return for Williamson Heating's stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents