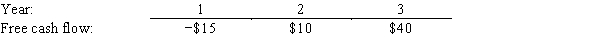

Heath and Logan Inc.forecasts the free cash flows (in millions) shown below.The weighted average cost of capital is 13%,and the FCFs are expected to continue growing at a 5% rate after Year 3.Assuming that the ROIC is expected to remain constant in Year 3 and beyond,what is the Year 0 value of operations,in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

Correct Answer:

Verified

Q8: Which of the following statements is CORRECT?

A)

Q9: Justus Motor Co.has a WACC of 11.50%,

Q22: Judd Corporation has a weighted average cost

Q25: Kinkead Inc.forecasts that its free cash flow

Q64: Connolly Co.'s expected year-end dividend is

Q65: Dyer Furniture is expected to pay a

Q75: If D1 = $1.50, g (which is

Q79: If D0 = $1.75, g (which is

Q83: Connor Publishing's preferred stock pays a dividend

Q90: Carby Hardware has an outstanding issue of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents