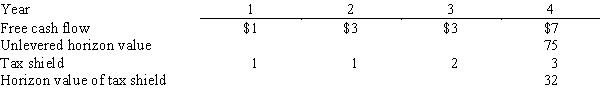

Raymond Supply,a national hardware chain,is considering purchasing a smaller chain,Strauss & Glazer Parts (SGP) .Raymond's analysts project that the merger will result in the following incremental free cash flows,tax shields,and horizon values:  Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?

Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?

A) $53.40 million

B) $61.96 million

C) $64.64 million

D) $76.96 million

E) $79.64 million

Correct Answer:

Verified

Q6: A parent holding company sells shares in

Q18: Firms use defensive tactics to fight off

Q21: Which of the following statements about valuing

Q28: A two-tier merger offer is one where

Q28: Holland Auto Parts is considering a merger

Q36: The distribution of synergistic gains between the

Q37: Juicers Inc.is thinking of acquiring Fast Fruit

Q41: Exhibit 26.1

Best Window & Door Corporation is

Q43: A regional restaurant chain,Club Café,is considering purchasing

Q45: Exhibit 26.1

Best Window & Door Corporation is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents