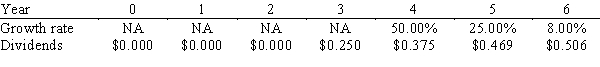

Sawchuck Consulting has been profitable for the last 5 years,but it has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value?

A) $9.94

B) $10.19

C) $10.45

D) $10.72

E) $10.99

Correct Answer:

Verified

Q73: McGaha Enterprises expects earnings and dividends to

Q85: The last dividend paid by Wilden Corporation

Q86: The last dividend paid by Coppard Inc.was

Q119: Suppose you borrowed $15,000 at a rate

Q141: DHF Company has a beta of 1.5

Q155: You plan to work for Strickland Corporation

Q161: Your 75-year-old grandmother expects to live for

Q239: Stuart Company's manager believes that economic

Q243: Orwell building supplies' last dividend was $1.75.Its

Q244: Joel Foster is the portfolio manager

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents