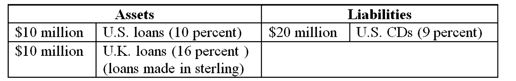

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-The weighted return on the bank's portfolio of investments would be

A) 15%.

B) 12%.

C) 16%.

D) 13%.

E) 7%.

Correct Answer:

Verified

Q63: A U.S. FI is raising all of

Q64: A U.S. FI is raising all of

Q65: How would you characterize the FI's risk

Q66: The following are the net currency

Q68: What is the portfolio weight of the

Q69: According to purchasing power parity (PPP), foreign

Q69: What is the portfolio weight of the

Q70: A U.S. FI is raising all of

Q71: A U.S. FI is raising all of

Q72: A U.S. FI is raising all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents