Multiple Choice

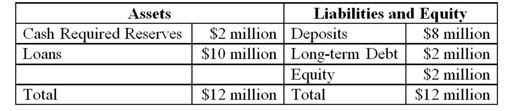

The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $3 million. Borrowing more debt will cost the bank 5.5 percent in the short term.

The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $3 million. Borrowing more debt will cost the bank 5.5 percent in the short term.

-What will be the cost of using a strategy of reducing its asset base to meet the expected decline in deposits? Assume that the bank intends to keep $2 million in cash as a liquidity precaution.

A) $10,000.

B) $15,000.

C) $30,000.

D) $40,000.

E) $50,000.

Correct Answer:

Verified

Related Questions

Q85: The price at which an open-end investment