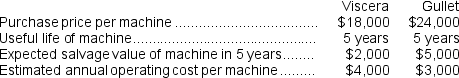

(Ignore income taxes in this problem.) Cannula Vending Corporation is expanding operations and needs to purchase additional vending machines.There are currently two companies,Viscera,Inc.and Gullet International,that produce and sell machines that will do the job.Information related to the specifications of each company's machine are as follows: Cannula's discount rate is 18%.Cannula uses the straight-line method of depreciation.Using net present value analysis,which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

Cannula's discount rate is 18%.Cannula uses the straight-line method of depreciation.Using net present value analysis,which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

A) Gullet, $127

B) Viscera, $1,562

C) Viscera, $1,749

D) Viscera, $3,438

Correct Answer:

Verified

Q57: (Ignore income taxes in this problem.)The management

Q58: (Ignore income taxes in this problem.)The following

Q59: Haroldsen Corporation is considering a capital budgeting

Q60: (Ignore income taxes in this problem.)Fossa Road

Q61: (Ignore income taxes in this problem.)Congener Beverage

Q63: (Ignore income taxes in this problem.)Welch Corporation

Q64: (Ignore income taxes in this problem.)Whitton Corporation

Q65: (Ignore income taxes in this problem.)A company

Q66: Facio Corporation has provided the following data

Q67: (Ignore income taxes in this problem.)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents