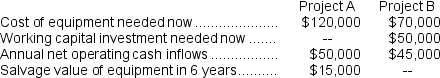

(Ignore income taxes in this problem.) Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

-The net present value of Project A is closest to:

A) $82,241

B) $67,610

C) $74,450

D) $81,290

Correct Answer:

Verified

Q116: (Ignore income taxes in this problem.) Westland

Q117: (Ignore income taxes in this problem.) Joetz

Q118: sales and expenses are projected:

Q119: (Ignore income taxes in this problem.) Morrel

Q120: (Ignore income taxes in this problem.) Joetz

Q122: Ignoring any salvage value,to the nearest whole

Q123: (Ignore income taxes in this problem.) Becker

Q124: (Ignore income taxes in this problem.) Paragas,

Q125: (Ignore income taxes in this problem.) Lambert

Q126: (Ignore income taxes in this problem.) Lambert

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents