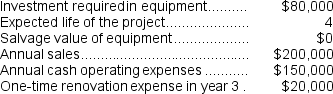

Lennox Corporation has provided the following information concerning a capital budgeting project: The company's tax rate is 35%.The company's after-tax discount rate is 8%.The project would require an investment of $20,000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.

The company's tax rate is 35%.The company's after-tax discount rate is 8%.The project would require an investment of $20,000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

A) $30,000

B) $26,500

C) $39,500

D) $50,000

Correct Answer:

Verified

Q23: Halwick Corporation is considering a capital budgeting

Q24: Inocencio Corporation has provided the following information

Q25: Dobrinski Corporation has provided the following information

Q26: (Appendix 13C) Stockinger Corporation has provided

Q27: Maurer Corporation is considering a capital budgeting

Q29: Bonomo Corporation has provided the following information

Q30: Marasco Corporation has provided the following information

Q31: Truskowski Corporation has provided the following information

Q32: Bratton Corporation has provided the following information

Q33: Schweinsberg Corporation is considering a capital budgeting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents