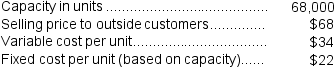

Mittan Products,Inc.,has a Antennae Division that manufactures and sells a number of products,including a standard antennae that could be used by another division in the company,the Aircraft Products Division,in one of its products.Data concerning that antennae appear below: The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae.

Assume that the Valve Division is selling all of the valves it can produce to outside customers.From the standpoint of the Valve Division,what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

A) $48,000

B) $136,000

C) $2,312,000

D) $152,000

Correct Answer:

Verified

Q3: Nanke Products,Inc.,has a Sensor Division that manufactures

Q4: The selling division in a transfer pricing

Q8: Division Delta of Golvin Corporation makes and

Q11: From the buying division's perspective, when a

Q11: Division G makes a part that it

Q13: Whenever the selling division must give up

Q21: Setting transfer prices at full cost can

Q24: If transfer prices are to be based

Q32: The transfer price used for internal transfers

Q165: The Southern Division of Barstol Company makes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents