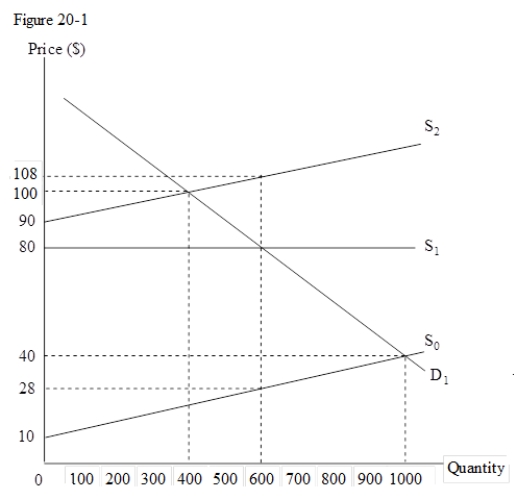

In the figure given below,D1 and S1 are the private demand and supply curves,of a commodity produced by a competitive firm.S2 reflects the social marginal cost of production,while S0 represents the external marginal cost.

-In Figure 20-1,if the government levies a tax of $8 per unit of output,then:

A) the marginal social benefit will exceed the marginal social cost and the good will be underproduced.

B) marginal social benefit will not exceed the marginal social cost and the good will not be overproduced.

C) marginal social benefit will exceed the marginal social cost and the good will be overproduced.

D) marginal social cost will exceed the marginal social benefit and the good will be overproduced.

Correct Answer:

Verified

Q66: The marginal social cost and marginal private

Q68: In the figure given below,the competitive supply

Q68: A tax used to internalize an external

Q69: If the production of a certain commodity

Q69: In the figure given below,the competitive supply

Q71: In the figure given below,the competitive supply

Q74: In the figure given below,the competitive supply

Q76: In the figure given below,D1 and S1

Q77: Externalities mainly arise because:

A)consumers have more market

Q78: In the figure given below,D1 and S1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents