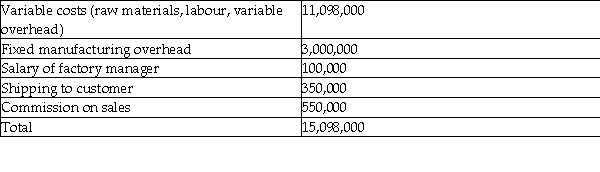

Albacore Sailboats manufactures small sailing dingies.In 2019,the company's accountant recorded the following costs into the inventory account:

The company had no work in process at the end of both 2018 and 2019.Finished goods at the end of 2018 amounted to 6,000 sailboats at $300/boat.Production was 50,000 sailboats and 4,000 boats remained in inventory at December 31,2019.The company uses a periodic inventory system and the FIFO cost flow assumption.

Required:

a.Of the $15,098,000,how much should have been capitalized into inventories?

b.Compute the ending value of inventory and the cost of goods sold for 2019.

c.If the error in inventory costing had not been corrected as per part (a),by how much would inventory be overstated at the end of 2019?

d.Record the journal entry to correct the error in inventory costing.

Correct Answer:

Verified

Q37: What are two reasons why an accounting

Q38: Zyler Company is analyzing its accounts

Q44: Sawatsky & Company Ltd is involved in

Q45: Wasson Company purchased land and a building

Q46: Grant Pharmaceuticals Ltd.undertook a research and development

Q47: Cantac Construction purchased a piece of equipment

Q47: Nicolla Company recorded the purchase of a

Q54: On June 30,2017,Whiggins Company received $60,000 from

Q62: Catherwood Inc.purchased a piece of real estate

Q66: Chesapeake Inc.issued a 7-year bond on October

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents