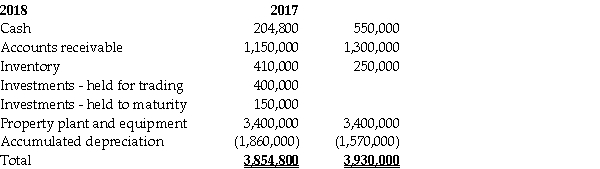

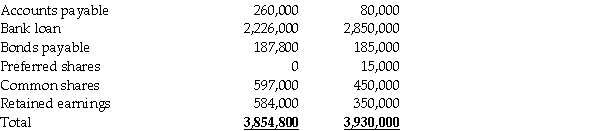

Financial information for Fesone Inc.'s balance sheet for fiscal 2017 and 2018 follows:

Additional information:

1.Preferred shares were converted to common shares during the year at their book value.

2.The face value of the bonds is $200,000;they pay a coupon rate of 6% per annum.The effective interest rate of interest is 8% per annum.

3.Net income was $290,000.

4.There was an ordinary stock dividend valued at $12,000 and cash dividends were also paid.

5.Interest expense for the year was $130,000.Income tax expense was $116,000.

6.Fesone arranged for a $200,000 bank loan to finance the purchase of the held-to-maturity investments.

7.Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities,respectively.

8.The held-for-trading investments are not cash equivalents.

Required:

a.Prepare a statement of cash flows for the year ended December 31,2018 using the indirect method.

b.Discuss how the transaction(s)above that are not reported on the statement of cash flows are reported in the financial statements.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: What is not a "non-cash" transaction?

A)Exchange of

Q28: Which item will be presented on the

Q28: What are investing activities?

A)Activities that do not

Q32: Complete the following:

a.List the three primary sources

Q35: Which statement is correct?

A)Cash flows are grouped

Q37: What are financing activities?

A)Activities involving the acquisition

Q43: Financial information for Fesone Inc.'s balance sheet

Q45: The activities for the year ended December

Q51: Provide a summary of presentation and disclosure

Q58: Which is a correct statement?

A)The direct method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents