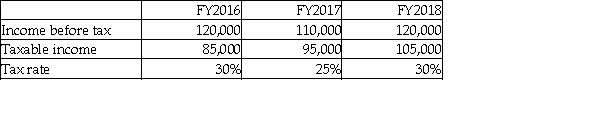

What is the deferred tax liability under the deferral method for FY2016?

A) $10,500

B) $25,500

C) $30,750

D) $36,000

Correct Answer:

Verified

Q21: A company earns $390,000 in pre-tax income,while

Q22: Which statement is correct?

A)Undepreciated capital cost (UCC)is

Q29: Which statement is correct?

A)The deferral and accrual

Q30: Which of the following is an example

Q33: SEG Company reported $490,000 in income tax

Q36: Under the accrual method,what is the current

Q39: What is a "taxable" temporary difference?

A)Results in

Q40: What is the deferred tax liability under

Q42: The following summarizes information relating to Gonzalez

Q47: When will there be a recapture of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents