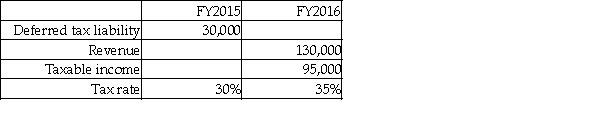

Under the accrual method,what is the effect of the tax rate change in FY2016?

A) Increase of 5,000.

B) Decrease of 5,000.

C) Increase of 30,000.

D) Decrease of 30,000.

Correct Answer:

Verified

Q44: A company has a deferred tax liability

Q46: Which is correct regarding the effect of

Q53: What is an "originating difference"?

A)The net carrying

Q59: A company has a deferred tax liability

Q63: How much tax expense would be recorded

Q66: What is the opening balance of the

Q67: What is the opening balance of the

Q68: What is the ending balance of the

Q69: Under the accrual method,what is the effect

Q70: The following summarizes information relating to Crockodile

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents