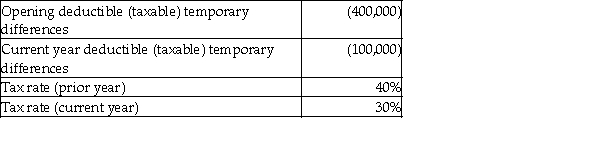

What adjustment is required to the opening deferred taxes as a result of the rate change?

A) 30,000 credit

B) 90,000 credit

C) 40,000 credit

D) 40,000 debit

Correct Answer:

Verified

Q31: Explain the large and growing amount of

Q42: A company has a deferred tax liability

Q70: In the first two years of operations,

Q73: In the first year of operations, a

Q74: Under the accrual method,what is the tax

Q75: How much tax expense would be recorded

Q76: How much tax expense would be recorded

Q77: What adjustment is required to the opening

Q80: In 2017,Graham Cracker Co.sells a building with

Q82: A company had taxable income of $2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents