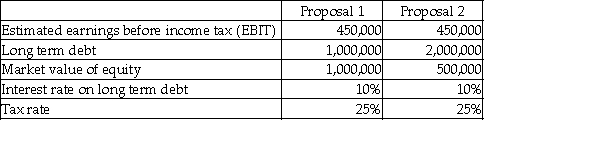

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity;net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Correct Answer:

Verified

Q3: What are "non-current liabilities"?

A)Obligations that are expected

Q4: Which statement is not correct about financial

Q5: Which statement is correct about financial leverage?

A)It

Q8: Bank Buy Inc.is in the process of

Q12: Which of the following would be a

Q28: What does an "AAA" credit rating mean?

Q32: What is meant by the "spread" charged

Q33: What is the role of debt rating

Q35: Why are banks able to pay such

Q36: Why do companies sell notes directly to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents