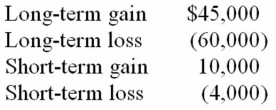

Mr. and Mrs. Philips recognized the following capital gains and losses this year.  Their AGI before consideration of these gains and losses was $140,000. Compute their AGI.

Their AGI before consideration of these gains and losses was $140,000. Compute their AGI.

A) $140,000

B) $131,000

C) $137,000

D) $143,000

Correct Answer:

Verified

Q62: Mr. Forest, a single taxpayer, recognized a

Q69: In 2010, Mrs. Owens paid $50,000 for

Q72: Which of the following statements about Section

Q73: Which of the following statements about investment

Q73: Which of the following statements about an

Q74: In 2010, Mrs. Owens paid $50,000 for

Q75: Which of the following statements about the

Q77: Ms. Beal recognized a $42,400 net long-term

Q80: In 1996, Mr. Exton, a single taxpayer,

Q91: This year,Mr.and Mrs.Lebold paid $3,100 investment interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents