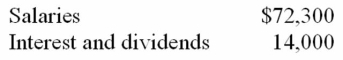

Mr. and Mrs. Sturm actively manage an office building that they purchased in January 1997. This year, the office building generated a $68,000 net loss. The couple's had the following sources of income  How much of the rental loss is deductible this year?

How much of the rental loss is deductible this year?

A) $0

B) $14,000

C) $25,000

D) $68,000

Correct Answer:

Verified

Q83: Lindsey owns and actively manages an apartment

Q83: Mrs. Heyer inherited real estate from her

Q90: Ms. Poppe, a single taxpayer, made three

Q92: Which of the following are included in

Q92: Bess gave her grandson ten acres of

Q94: Ms.Plant owns and actively manages an apartment

Q94: Mr. Vernon owns stock in two S

Q97: Mr. Lainson died this year on a

Q98: Mr. and Mrs. Gupta want to make

Q99: Mr. Lee made the following transfers this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents