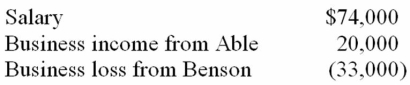

Mr. Vernon owns stock in two S corporations, Able Corporation and Benson Inc. This year, Mr. Vernon had the following income and loss items.  If Vernon materially participates in Able's business but not in Benson's business, compute his AGI.

If Vernon materially participates in Able's business but not in Benson's business, compute his AGI.

A) $94,000

B) $74,000

C) $61,000

D) $41,000

Correct Answer:

Verified

Q83: Lindsey owns and actively manages an apartment

Q83: Mrs. Heyer inherited real estate from her

Q90: Ms. Poppe, a single taxpayer, made three

Q92: Bess gave her grandson ten acres of

Q93: Mr. and Mrs. Sturm actively manage an

Q94: Ms.Plant owns and actively manages an apartment

Q97: Mr. Lainson died this year on a

Q98: Mr. and Mrs. Gupta want to make

Q99: Mr. Lee made the following transfers this

Q99: Which of the following reduce a decedent's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents