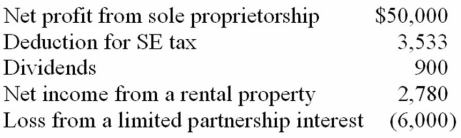

Mr. and Mrs. Nelson operate a small business as a sole proprietorship. This year, they have the following tax information.  Compute Mr. and Mrs. Nelson's AGI.

Compute Mr. and Mrs. Nelson's AGI.

A) $50,900

B) $47,367

C) $50,147

D) None of the above

Correct Answer:

Verified

Q72: Which of the following statements about Section

Q77: Ms. Beal recognized a $42,400 net long-term

Q79: Mr. Quinn recognized a $900 net short-term

Q80: Kate recognized a $25,700 net long-term capital

Q81: Last year, Mr. Margot purchased a limited

Q83: Which of the following statements about the

Q84: Ms. Watts owns stock in two S

Q86: In 2010, Mr. Yang paid $160,000 for

Q87: Ms. Cowler owns stock in Serzo Inc.,

Q94: Mr. and Mrs. Perry own stock in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents