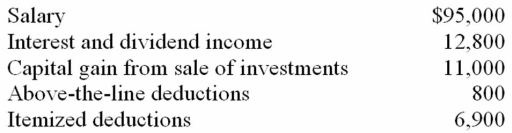

Julie, an unmarried individual, lives in a home with her 13-year-old dependent son, Oscar. This year, Julie had the following tax information.  Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.

A) AGI $118,000; taxable income $104,450

B) AGI $118,000; taxable income $94,800

C) AGI $118,000; taxable income $101,700

D) AGI $107,000; taxable income $90,700

Correct Answer:

Verified

Q42: The unextended due date for the individual

Q46: Samantha died on January 18, 2011. Her

Q47: Which of the following taxpayers can't use

Q52: Mr. and Mrs. Liddy, ages 39 and

Q53: Mrs. Raines died on June 2, 2011.

Q54: Mr. Jones and his first wife were

Q55: Leon died on August 23, 2010, and

Q56: In determining the standard deduction, which of

Q57: Mr. and Mrs. Eller's AGI last year

Q58: Which of the following statements regarding filing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents