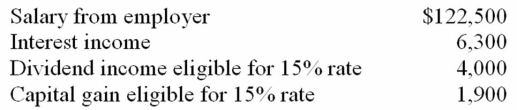

Mr. and Mrs. Daniels had the following income items in 2012:  Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

A) $20,270

B) $21,363

C) $22,248

D) $23,559

Correct Answer:

Verified

Q85: Mr.and Mrs.Lansing,who file a joint tax return,have

Q86: Mr.and Mrs.Kain reported $80,000 AGI on their

Q86: Mr. and Mrs. David file a joint

Q87: Mr. and Mrs. King's regular tax liability

Q88: Mr. and Mrs. Stern reported $312,400 alternative

Q90: Mr. and Mrs. Borem spent $1,435 for

Q92: Mr. and Mrs. Harvey's tax liability before

Q93: Linda and Raj are engaged to be

Q95: Mr. and Mrs. Luang reported $417,900 ordinary

Q96: Mr.and Mrs.Cox reported $115,900 AGI on their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents