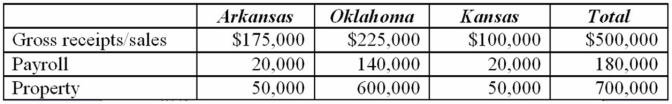

Tri-State's, Inc. operates in Arkansas, Oklahoma, and Kansas. Assume that each state has adopted the UDITPA formula. During the corporation's tax year ended December 31, the apportionment data indicated:  Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?

Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?

A) $250,000

B) $218,125

C) $44,375

D) $173,750

Correct Answer:

Verified

Q44: Which of the following statements concerning the

Q47: Albany, Inc. does business in states C

Q47: Which of the following could result in

Q50: Tri-State's, Inc. operates in Arkansas, Oklahoma, and

Q51: Cambridge, Inc. conducts business in states X

Q53: Verdi Inc.has before-tax income of $500,000.Verdi operates

Q53: GAAP-based consolidated financial statements include only income

Q55: Economic nexus:

A) May exist even though a

Q57: A controlled foreign corporation is a foreign

Q60: Section 482 of the Internal Revenue Code

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents