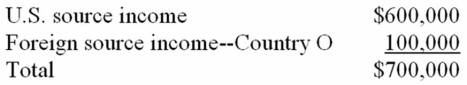

Jokar Inc., a U.S. multinational, began operations this year. Jokar had pretax U.S. source income and foreign source income as follows.  Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.

Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.

A) $213,000

B) $221,000

C) $204,000

D) $238,000

Correct Answer:

Verified

Q48: Which of the following statements about the

Q56: Transfer prices cannot be used by U.S.

Q62: San Carlos Corporation, a U.S. multinational, had

Q63: Mega, Inc., a U.S. multinational, has pretax

Q67: Which of the following statements about organizational

Q69: Global Corporation, a U.S. multinational, began operations

Q72: Which of the following statements about the

Q73: Which of the following would qualify as

Q79: Which of the following statements about the

Q96: If a U.S.multinational corporation incurs start-up losses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents