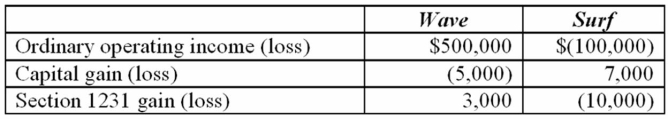

Wave Corporation owns 90% of the stock of Surf, Inc. Each corporation reports the following separate items for the current tax year:  Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

A) $400,000

B) $395,000

C) $410,000

D) $500,000

Correct Answer:

Verified

Q29: A corporation that is unable to meet

Q33: The corporate alternative minimum tax rate is

Q44: In its first taxable year,Platform,Inc.generated a $200,000

Q45: Corporations are rarely targeted in political debates

Q46: Thunder, Inc. has invested in the stock

Q47: Westside,Inc.owns 15% of Innsbrook's common stock.This year,Westside

Q49: Which of the following statements regarding the

Q58: Aaron, Inc. is a nonprofit corporation that

Q59: The burden of corporate taxation is often

Q67: Palm Corporation has book income of $424,000.Book

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents