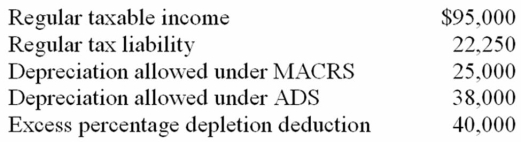

Loraine Manufacturing, Inc. reported the following for the current tax year:  What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

A) $55,000

B) $135,000

C) $122,000

D) $82,000

Correct Answer:

Verified

Q49: Fleet, Inc. owns 85% of the stock

Q63: Morton Inc. is a Kansas corporation engaged

Q66: TasteCo,Inc.reported $210,500 of taxable income this year.What

Q66: Calliwell Corporation is a Colorado corporation engaged

Q67: Calliwell Corporation is a Colorado corporation engaged

Q68: Honu,Inc.has book income of $1,200,000.Book income includes

Q73: Which of the following statements regarding Schedule

Q74: Which of the following statements regarding the

Q86: Alexus Inc.'s alternative minimum taxable income before

Q99: Which of the following could cause a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents